PROGRESS UPDATE

Original Debt (December 14, 2012): $102,645

Current Debt (32 months later): $85,308

My debt has decreased by an overall reduction of $17,337 in 32 months. I’m now at 16.89% of my debt payoff goal.

DEBT BREAKDOWN

Federal Student Loans $61,342 $61,770 (An overall increase of $5,893 in 32 months)

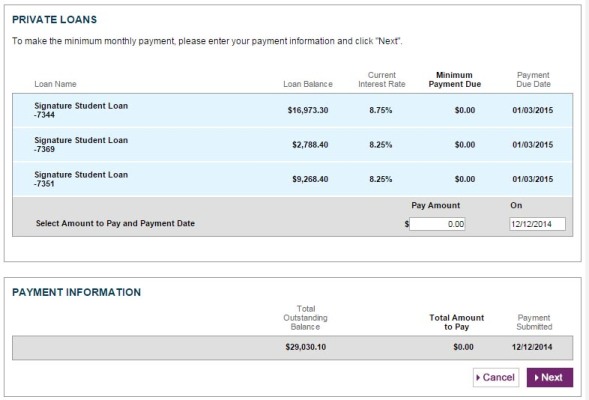

Private Student Loans $24,715 $23,538 (An overall decrease of $17,553 in 32 months)

- StudentLoan#2:

$7,949$7,045 (an overall decrease of $5,327 in 32 months) - StudentLoan#3:

$16,766$16,493 (an overall decrease of $1,766 in 32 months) StudentLoan#1: $0Paid in Full- Original Balance: $6,300

- Capitalized Interest: $1,663

- Paid Since Start of Blog: $8,119; Amount Towards Interest: $918

- Total Amount Paid (full life of loan): $9,415

- Total Towards Interest (full life of loan): $2,890

StudentLoan#4: $0Paid in Full- Original Balance: $6,288 (-$3,288 School Refund…they took out too much)

- Capitalized Interest: $802

- Paid Since Start of Blog: $4,645; Amount Towards Interest: $918

- Total Amount Paid (full life of loan): $5,933

- Total Towards Interest (full life of loan): $2,504